The Fed did nothing today, except note that there are problems in the rest of the world, but everything here is fine. Nevertheless in the spirit of noblesse oblige the Fed has condescended not to raise its benchmark rate by 25 basis points. It's good to be the king.

And after they did nothing, the dollar fell sharply, stocks staged a spectacular rally with an even more spectacular retracement to finish negative, and of course the precious metals took off for a little run higher.

That was quite a bit of action for something that 'everybody knew.'

The skeptical me is pretty much ignoring the Fed at this point except for the diversion of seeing them trying to wriggle out of the corner into which they have painted themselves. On one hand they say all is well, and on the other they would dearly like to get off the zero bound but cannot find the traction to do it, amidst all this lousy economic data.

And so they do nothing, and blame China or the weather or anything else but their own monetary fan service for the libertines of Wall Street.

A more interesting development to me at least is in the precious metals market.

I know there are some who are more than glad to just discount all of it as business as usual, but I do not think the data supports that premise.

That does not preclude the possibility that the bullion banks may wriggle and bluff their way out of this one, again, most likely with the help of some friendly central banks leasing out more physical bullion on the cheap, again. But the general trend of what I have come to call 'the gold pool' is not promising, and could prove to be of some more than passing interest to us.

To that end I put out a briefing overnight titled Timely Caution Is Advisable With Your Gold Holdings with a companion piece, On the LBMA and Their Unallocated Holdings .

You may wish to read them both carefully. With regard to the latter, someone forwarded an email message from Jim Rickards that says "Jesse has this right."

More importantly I hope Jim R. has it right, since he has much better sources of information.

Here is a thumbnail sketch of the situation.

There is an unusual amount of extra leverage in the precious metals, not only in the Comex but apparently in the LBMA. The London market is the more important echange because it is the bullion gateway to the East and a more physical exchange by design, despite the recent rigging scandals there which are apparently not fully resolved in transparency.

It is thought that some very serious players may have been found offsides and badly short of physical bullion in London, thanks to their usual gambling antics and the inexhaustible bullion maws of Asia.

And the problem may be even worse because not only are these players short, but on the whole the exchange itself is tight on the old claim checks to items counts. In other words, the bullion may not even be there at the current prices. Even in a fairly big pond the whales can make waves.

Comex is easy to manage, because it is more of a betting shop, dominated by a few players who are willing to cash settle, whether by design or professional courtesy. Although this does allow for some oddities in the reports that everyone is urged to ignore because 'you just don't understand.'

And in that vein we had almost no 'deliveries' at The Bucket Shop yesterday, but the warehouses continue to mark a steady bleeding out of physical bullion. Along with the Western ETFs and Funds by the way. Nothing of note there, move along.

Today's move higher in metals prices was a good start to clearing up any short term inconveniences in supply, but it may have to go a bit higher, like a hundred dollars or so at least. Unthinkable!

And it would be a good time to remind everyone that gold itself does not vary, but the prices of other currencies including the dollar are fluctuating against it. Gold has preeminence as a currency because in its physical form it bears no counterparty risk.

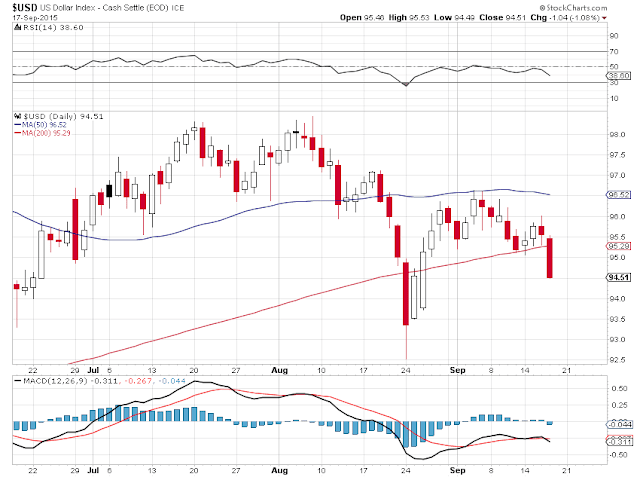

And gold has been rallying against a broad set of other currencies for a while now, but not so much the dollar.

Caution in uncertainty is not a bad course of action. Especially when the only certainty is change, and the gales of November come early.

Have a pleasant evening.