"I write to you from a disgraced profession. Economic theory, as widely taught since the 1980s, failed miserably to understand the forces behind the financial crisis.

Concepts including “rational expectations,” “market discipline,” and the “efficient markets hypothesis” led economists to argue that speculation would stabilize prices, that sellers would act to protect their reputations, that caveat emptor could be relied on, and that widespread fraud therefore could not occur."

James K. Galbraith

There are several somewhat surprising assertions in this piece below from Paul Krugman, which left me almost speechless. But not quite.

I might be unfair in taking it seriously, or more seriously than one should do with what could be just a politically motivated puff piece. The Western central banks seem to be 'in a jam' as it were, and now is the time for all their men to come to the aid of the financial status quo.

First, Krugman is touting the fiat petro-dollar as somehow

humanitarian, as compared to apparently the worst mine he could find, in order to throw stones at the gold industry. Or presumably anything

real that comes out of or off of the ground for that matter, including natural resources and agricultural products, because one can find abuse of labour in all of them.

This is so off handed hypocritical as to be mind-boggling.

I think we can stipulate that abuses of capital and power can and do exist in any human endeavor, and the proper but occasionally underutilized role of government is to mitigate them.

Considering the carnage that the financial industry and the Banks have wreaked on the real economies of the world, I hope the hypocrisy here is obvious to anyone with any sense of current events whatsoever. Certainly we have no excuse to blind ourselves to the all too recent and terrible role of crony capitalism in destroying lives around the world in the endless pursuit of power, and the supremacy of greed. And that power is based largely on the dollar.

This is the great failing in Modern Monetary Theory. It assumes that if we make the creation of money easy enough, it will make the people who hold that power naturally virtuous, because it takes less effort to be good and so they will choose to be good.

This is the Zimbabwe school of public policy, and the John Law Institute of Economic Thought. The 'scholar-gentry' somehow imagine themselves as nature's virtuous wise men, operating for the objective good, but the serial bubbles and crises in the West over the past twenty years show how this assumption is part of the efficient market hypothesis: a romantic canard.

Then Paul Krugman takes on Bitcoin. He posits it as based on a great mine located in Iceland that creates bit coins because it is cold there and electricity is cheap. I thought he might be speaking sardonically, but I'm not so sure.

Engineering students I know and their college friends mine bitcoins and litecoins from their dorm rooms, which are not particularly cold, but where electricity is essentially free. However the amount of electricity used is so minimal that it really doesn't matter. But this is besides the real point.

What threw me for a loop was his snarky punch line designed to put the whole idea of Bitcoin to bed.

"we’re burning up resources to create “virtual gold” that consists of nothing but strings of digits..."

If this is not the very description of the modern dollar, except for the

burning up resources line, used by Ben Bernanke in his famous speech in which he says that deflation is not a problem for a Fed that 'owns a printing press,' I don't know what is. I might say

misallocating resources to the financial sector rather than

burning up resources, but that may be a nicety.

Krugman derides Bitcoin as 'virtual gold' but in reality it is much closer to 'virtual dollars' because both are created out of essentially nothing but a few key strokes and cycles on a computing machine.

Bitcoin has a limiting factor built in to it. Gold has a limiting factor in its natural scarcity.

The primary difference is that the dollar is backed by the power of the state, and bitcoins are relatively stateless, which is their weakness. Gold's power is that the state cannot create it, merely abuse it.

This whole 'progress' concept is just a canard, as is the localizing of the view of gold to a few eccentric gold bugs.

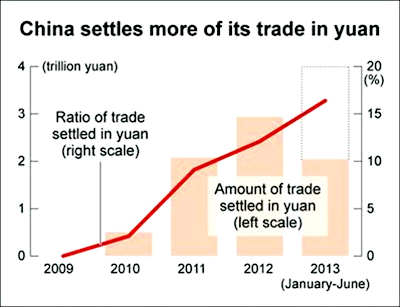

If China and a few other central banks were not buying gold, and in size, there would be no issue here, and the status quo based on the Western dollar would not feel so threatened. Are China and these others merely ignorant gold bugs? Or are they reacting to a situation in a way that people have done throughout history?

They are seeking a refuge from the abuse of power by a status quo.

There is a classic policy disagreement about the international monetary system underway, which some have taken to calling

a currency war, and most establishment economists are ignoring it, or talking it down. And this is why the next financial crisis is going to hit them smack in the face, like the last two crises which they aided and abetted, if nothing else than by their silent acquiescence.

Fiat money has been tried many, many times in the past, especially over the last few centuries. It has ended in the same manner every time.

As Bernard Baruch observed, '“Gold has worked down from Alexander's time... When something holds good for two thousand years, I do not believe it can be so because of prejudice or mistaken theory.”' Baruch the financier understood money and markets. He was no servile economist, caught in a credibility trap.

Rather than dealing with reality, and understanding

why people throughout history seems to be 'voting' in certain ways when there is a choice, and why China and other Asian and Mideastern nations and their central banks are buying gold in sizable quantities, Mr. Krugman just writes this off as some eccentricity, because it does not fit his model of

how things should be.

And this is the stance of a statist, and it requires increasing use of force as people reject its falsity. It appears to be mere sophistry in the service of power, and it is unworthy. But this is economics today, cheerleaders for their favorite brand of political power. It is after all a social science more often used to rationalize rather then explain, except in its most basic elements and in its practical microeconomic applications.

Arguing for stimulus without acknowledging and addressing the flaws and obvious policy mistakes in the system that have led to multiple and increasingly destructive asset bubbles is beyond reckless, and almost wanton. But it is politically advantageous.

If Mr. Krugman were to honestly study what money is, rather than what he wishes it to be, things might be clearer and his thinking might be richer. Alan Greenspan has done this, but then he subordinated his knowledge to his careerist aspirations.

And perhaps this is what exercised me to write this more than anything else. As an academic economist and 'very serious person,' Krugman is arguing like a Fox news anchor, assaulting knowledge to score his political points. He is cloaking his policy advocacy in the trappings of his profession, and he thereby cheapens it. And this is why it has become disgraced.

Let me be clear on this. I am not proposing that gold become a new monetary standard. I think that a new international monetary regime will evolve, and that gold will play some part.

But I am saying that the public policy proposals put forward by economists are too often stuff and nonsense, merely rationales used to promote whatever ideology or power group they believe in, or seek to curry favour with, in the first place. And that the power to create money and distribute it is a deadly power, and has led to failures repeatedly over and over again. So safeguards must be taken with it.

And if gold is such a dead issue, then why does Krugman need to argue so bitterly against it, resorting to sophistry and ridicule and appeals to authority? It is because he is trying to force an argument against the will of a sizeable portion of the world's people. It is a policy battle, with good points and bad points. But he chooses not to argue it honestly, exposing the good and the bad, but politically and cheaply.

These economic 'laws' are almost always arguments, but not

proofs. But cloaked as proofs they help to overturn common sense all too often, and this has proven to be a tragedy as is so common with all quack scientific theories.

As I noted

a few weeks ago:

"Economics is a profession that succumbed almost en masse, whether by individual actions or the complicit silence of careerism, to the pervasive corruption of financial fraud, and of the persuasive power of Wall Street, the Banks, and big money. The only group that approaches their failure is the national political and financial class, including the accountants and the regulators.

For the most part this has not yet changed because of the unreformed state of the financial system, combined with the snare of the credibility trap. And they cover their shame by calling themselves the 'scholar-gentry' and tut tutting about the failure of the public in much the same tones that the plutocrats of past colonial empires would agonize over the plight of the victims of their perfidy in terms of the white man's burden."

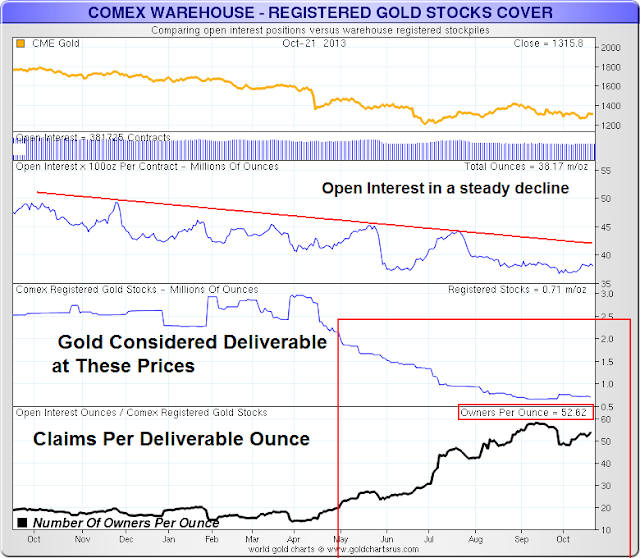

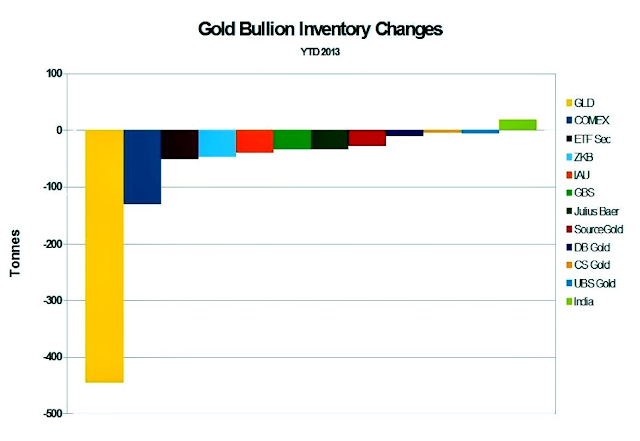

I strongly suspect that some of the Western central banks, led on by the bullion banks, have made some awful policy errors in the disposition of their nation's resources over the past ten years. They have committed resources to what they considered a just cause without sufficient diligence, things that do not rightly belong to them, thinking that they could retrieve them at some future date without too much effort.

And like any other client of the banks, they have been taken. With the inability to return the national gold to Germany as their people had requested, the bankers were staring into the abyss. So they have sought to cover this up, and thereby keep digging themselves into an ever deeper hole. And this will prove to be worse than the original deed once it is resolved. It will destroy careers.

The would-be ruling class envisions a relatively unconstrained money supply as a tool amenable to the beneficent use of themselves as philosopher-kings. And it is another romantic falsehood like the efficient market theory. Whose fiat, who decides?

Such a monetary authority gives the power to determine

and distribute value and worth to a relatively small group of people who act on their own authority, and too often in secrecy. Well, we essentially have had that for some time, and as Dr. Phil might say,

'And how's that been working for you?

The implementation of romantic ideals in pursuit of an ideal paradise would quite likely result in a hell on earth. The resort to force will become increasingly necessary, predatory, self-serving, and relentless.

Addendum: I have addressed Paul Krugman's 'quote' from Adam Smith in more detail

here.

NYT Times Op-Ed Columnist

Bits and Barbarism

By Paul Krugman

December 22, 2013

This is a tale of three money pits. It’s also a tale of monetary regress — of the strange determination of many people to turn the clock back on centuries of progress.

The first money pit is an actual pit — the Porgera open-pit gold mine in Papua New Guinea, one of the world’s top producers. The mine has a terrible reputation for both human rights abuses (rapes, beatings and killings by security personnel) and environmental damage (vast quantities of potentially toxic tailings dumped into a nearby river). But gold prices, while down from their recent peak, are still three times what they were a decade ago, so dig they must.

The second money pit is a lot stranger: the Bitcoin mine in Reykjanesbaer, Iceland. Bitcoin is a digital currency that has value because ... well, it’s hard to say exactly why, but for the time being at least people are willing to buy it because they believe other people will be willing to buy it. It is, by design, a kind of virtual gold. And like gold, it can be mined: you can create new bitcoins, but only by solving very complex mathematical problems that require both a lot of computing power and a lot of electricity to run the computers.

Hence the location in Iceland, which has cheap electricity from hydropower and an abundance of cold air to cool those furiously churning machines. Even so, a lot of real resources are being used to create virtual objects with no clear use. (Paul K. does not understand how Bitcoin works.

The third money pit is hypothetical. Back in 1936 the economist John Maynard Keynes argued that increased government spending was needed to restore full employment. But then, as now, there was strong political resistance to any such proposal.

Clever stuff — but Keynes wasn’t finished. He went on to point out that the real-life activity of gold mining was a lot like his thought experiment. Gold miners were, after all, going to great lengths to dig cash out of the ground, even though unlimited amounts of cash could be created at essentially no cost with the printing press. And no sooner was gold dug up than much of it was buried again, in places like the gold vault of the Federal Reserve Bank of New York, where hundreds of thousands of gold bars sit, doing nothing in particular.

Keynes would, I think, have been sardonically amused to learn how little has changed in the past three generations. Public spending to fight unemployment is still anathema; miners are still spoiling the landscape to add to idle hoards of gold. (Keynes dubbed the gold standard a “barbarous relic.”) Bitcoin just adds to the joke. Gold, after all, has at least some real uses, e.g., to fill cavities; but now we’re burning up resources to create “virtual gold” that consists of nothing but strings of digits...

Read the entire op-ed here.