“It was written I should be loyal to the nightmare of my choice.”

Joseph Conrad, Heart of Darkness

"Judge them by their works. What have they done for mankind beyond the spinning of airy fancies, and the mistaking of their own shadows for gods?"

Jack London, The Iron Heel

That first quote is for Bernie Sanders, and that second sums the substance of the Fed.

I think that the gold and silver prices got pegged to the price that pleased those who wanted to take the most out of the pockets of the non-professional (directional) options players.

Tomorrow will be the FOMC, and we may see a move, depending on just what the Fed decides to do.

I can see them doing nothing, or raising 25 bp and getting it over with. I put it at almost 50-50. They are running out of time to act from a practical standpoint, but the financial system is so shaky that they are paralyzed by fear of doing anything that will cast a finger of blame in their direction.

I will not go into all the reasons, but it does not have much to do with the real economy. They are preoccupied with managing their policy options against the risks from their financial asset bubbles, as well as the needs and desires of their real constituents, the Banks.

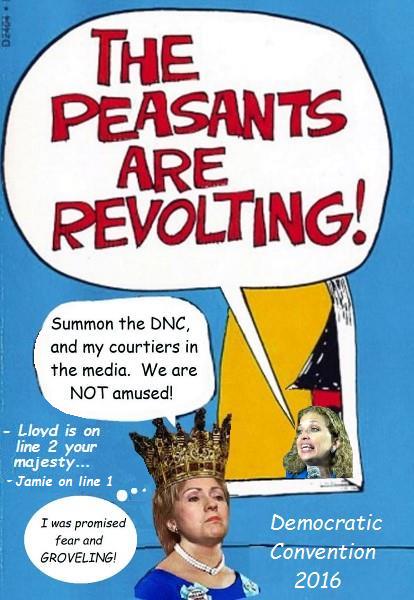

Tonight Bill 'Slick Willy' Clinton will be speaking to the Democratic Convention. It would be a real stunner if he was booed, even sporadically. For all his shortcomings and flaws, he is a very good speaker and has a following amongst the hard core of the Party establishment.

I won't be watching. To put it bluntly,

Slick makes me sick. And I am already there with both of the presumptive nominees. It is going to be a long four years ahead.

There will be a lot of political kabuki theatre tonight. I suspect that Bernie Sanders will release his delegates, at least in the Vermont delegation, in order to try and put Hillary over the top as the nominee in a show of unity.

His constituents and volunteers seem to have been roundly let down, if not betrayed. Especially in the light of the manner in which Hillary corrupted the DNC and bent it to her will, the voters and the law be damned, and the clumsy propaganda she put out to try and distract away from it.

I am putting my money on karma, but that takes time.

Oh well, politics is a dirty business.

At least gold does not tarnish easily.

Have a pleasant evening.